Customer Relationship Management (CRM) solutions have become pivotal in the Life Sciences.

The driving force? Their potential to:

- Streamline operational processes and communication through automation,

- Enhance healthcare professional (HCP) and patient relations,

- Use data insights to predict market trends

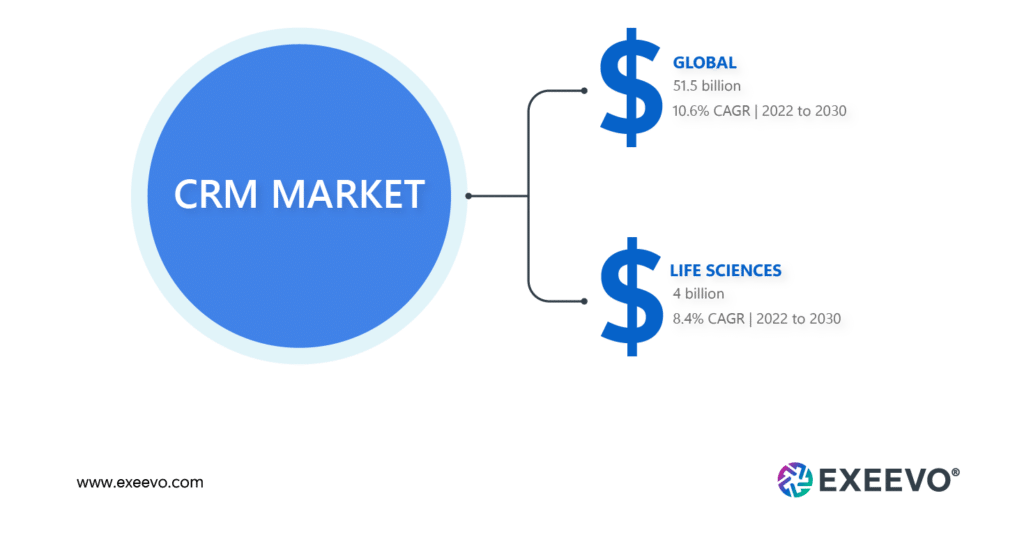

In 2022, the global CRM market saw a staggering valuation of $51.5 billion, with a forecasted CAGR of 10.6% from 2022 to 2030. Digging deeper, the Healthcare CRM segment alone was worth $16.0 billion in 2022, with $4 billion attributed to Life Sciences or 25% of total healthcare. all of which had a projected growth rate of 8.4% CAGR from 2022 to 2030.

But the impressive numbers come with a pressing concern: the perceived high Life Sciences CRM costs. For many, these tools can seem expensive, raising questions about their value proposition and strategic implications. But is that the case? Or is there more than meets the eye?

We’ll pull back the Life Sciences CRM pricing layers in this strategic review. This guide presents new viewpoints to optimize your Life Sciences CRM investments for seasoned executives and field newcomers.

Why is Life Sciences CRM so Expensive?

Life Sciences CRMs can be expensive due to several unique challenges and requirements specific to the industry:

In the race to enhance customer experiences, Life Sciences leaders aim to use new technologies to improve interactions with HCPs and patients.

While Life Sciences companies need suitable technologies to address data silos and disconnected messaging across their customer channels, they also need to address shortfalls and gaps in the skillsets they can call on across their organization and ensure they can operate with sufficient agility to achieve strategic goals focused on CX-driven objectives..

However, the benefits of Life Sciences CRMs are notable; various factors drive their costs. The most significant is the oligopoly in the CRM vendor market. As only a small number of significant providers dominate the industry, there is a lack of competitive pressure to lower rates. Additionally, using legacy applications within pharmaceutical companies introduces extra costs for integration and customization efforts.

In a perfect scenario, the market’s expansion should lead to increased competition. But historical industry practices play a role. Life Sciences companies tend to be risk-averse and prefer established providers to reduce uncertainties. This preference for more prominent players limits competition, innovation, and savings.

Businesses witness a return of $8.71 for every dollar invested in CRM. This return has increased over the years, which shows the positive impact and value of CRM investments.

Life Sciences CRM Cost Drivers

Understanding the ins and outs of any CRM investment begins with recognizing its cost drivers.

What are the cost drivers?

They’re the key factors that determine how the price is set. Each driver plays a specific role in the cost of the CRM tool.

Why is this crucial?

Knowing these drivers is about more than understanding the price tag. It’s about having the right information to make informed decisions. Whether selecting a new CRM provider or negotiating terms, having this knowledge can give you the upper hand. In essence, it’s about ensuring the best return on your investment.

In the upcoming sections, we’ll discuss each specific cost driver. This will give you a clearer picture of where your money is going and an understanding of the CRM’s value proposition.

1. Complex Industry-Customer Relationship

The complexity of industry-customer relationships is a significant driver of costs in the Life Sciences CRM domain. The pharmaceutical industry operates within a complex ecosystem of interactions involving HCPs, patients, regulatory bodies, and various stakeholders. This intricate network creates unique challenges and requirements that contribute to the higher costs of CRM systems in pharma.

The evolving nature of these relationships necessitates that modern CRM solutions be adaptable, customizable, and capable of handling intricate data structures and specialized workflows.

Life Sciences organizations focus on:

- Innovation and R&D

- Collaboration and Partnerships

- Market expansion

They must adapt to shifts in the market, such as digital delivery and personalization, to meet customer expectations.

HCPs now prefer digital information delivery. This prompts a shift toward more agile digital touchpoints for a seamless customer journey. But the unique challenges persist. Selling prescription drugs involves many stakeholders, like HCPs and payers, which makes customer relationship management complex. Regulatory restrictions also play a crucial role in these interactions.

While the uncommon structure of the biopharma sector justifies complex CRM needs, questions arise about ongoing Life Sciences CRM costs.

Customizations to reflect stakeholder relationships are in place, and stability in the industry means limited core system updates. Despite this, high costs persist, raising questions about their justification. The challenge remains: Why hasn’t the complexity-driven cost reduced over time?

2. Volume of Customer Data for Insights

The increasing volume of customer data and the need for insights drive Pharma CRM costs. Recent data growth trends have implications for CRM systems, which require adaptations to capture valuable insights. Pharma companies must shift from relying on metrics and past research to focusing on customer behavior and challenges for practical insights.

Real customer actions and feedback are crucial for a customer-first approach, leading to more effective marketing tactics. Leveraging customer behavior data generates 40% more revenue. But, traditional CRM platforms often lack the depth of customer data needed for these insights. Legacy CRMs struggle to provide holistic views and access to different functions.

Massive data accumulation is standard, with pharma doubling its data (DNA-related) every five months. Data standardization processes can be costly and may not yield enough insights. While various industries face data challenges, some pay less for their CRMs despite similar complexities.

Advanced AI techniques like machine learning and chatbots transform CRMs. They deliver personalized experiences and adapt to challenges like remote interactions due to factors like the COVID-19 pandemic. These advancements promise cost savings and improved customer engagement.

McKinsey’s report states that implementing big-data strategies for informed decision-making can create around $100 billion in annual value within the US healthcare system.

3. Highly Regulated Market

The stringent regulations in the pharmaceutical industry drive up the costs of Life Sciences CRM systems. Compliance with regulations from entities like the FDA is crucial. CRM solutions in pharma must adhere to strict data security, privacy, and reporting standards. This ensures trustworthy interactions with HCPs and patients.

Meeting these standards requires data validation, audit trails, and documentation efforts. These contribute to higher expenses for system development, customization, and upkeep.

For instance, companies tailor systems for legal and medical commentary to route around marketing materials. These adjustments include content changes and distinct firewalls between teams, such as Medical Affairs and Commercial.

Moreover, evolving regulatory requirements lead to ongoing updates and changes in CRM systems. Staying compliant while accommodating these alterations drives up costs. The complicated approval processes for new features or updates extend development timelines, increasing expenditures.

But some arguments seem less convincing upon closer examination. The stability of regulatory laws over time – except for China with the PIPL regulations – implies that companies have already integrated these factors into their existing CRM systems. Templating and automation can also streamline content related to med-legal, reducing expenses.

Why do pharmaceutical companies continue to pay higher pharma CRM costs considering these points? It’s essential to address any recent regulatory changes or industry challenges. Modern CRMs ensure compliance with evolving regulations. These CRMs provide solutions that adapt to the dynamic market.

The Truth About Life Sciences CRM Costs

Traditionally, the real reason behind the high costs of Life Sciences CRM has been the limited number of vendors. The small pool has resulted in an oligopoly. In simpler terms, only a few major players dominated the field and were less incentivized to lower prices or innovate. Consequently, companies seeking Customer Relationship Management (CRM) solutions found themselves bound to a market where the choice was limited and a handful of powerful entities dictated pricing. With fewer companies competing, there was less pressure to offer better functionality, improve services, or offer affordable licensing options.

In comparison, other less regulated B2B industries have a depth of CRM providers to choose from, which propels the creation of more innovative, customer-focused solutions that cater to businesses’ varied and evolving needs. Companies, in turn, benefit from having a range of options to choose from, ensuring that they can select a CRM system that best aligns with their requirements and budget.

The Future of Life Sciences CRM

The future of Life Sciences CRM is intertwined with the evolving nature of the pharmaceutical industry, which sees digital-first solutions playing an ever larger role. Next-generation CRM solutions that offer generative AI are now a must in this context to navigate through the dynamic and competitive landscape of the industry.

However, the older legacy Life Sciences CRM solutions have yet to keep pace with mainstream B2B CRM solutions or reflect the new reality of pharmaceutical organizations’ needs. These vendors are now forced to contend with disgruntled customers who are no longer willing to accept price gouging along with their inability to:

All of which highlight the importance of selecting a future-proof option.

Exeevo Omnipresence is a CRM tailored to meet the current and future needs of the Life Sciences sector. Device agnostic and built on the architecture of Microsoft Dynamics 365, Omnipresence brings multiple business applications together in a unified system, coupled with advanced analytics to reveal insights, drive wiser decisions, and unleash new opportunities for commercial growth.

The pharmaceutical industry demands quick and personalized communication with HCPs. Omnipresence provides scalable global cloud-enabled communication to address these needs and exceed HCP expectations. It provides a unified omnichannel journey with multiple touchpoints for commercial, marketing, events, medical affairs, service and more.

Below are some reasons why Omnipresence is the right choice as a Life Sciences CRM:

As we look to the future, pharmaceutical organizations will require a CRM solution to become even more intricate and tailored, offering insights that were once thought to be unattainable. Machine learning and AI will fine-tune predictive analyses, ensuring that medical professionals and researchers can provide more personalized care and groundbreaking solutions to age-old challenges. Next-gen solutions will streamline workflows, bolster innovation, and foster an era of unparalleled collaboration. However, the future of Life Sciences can only advance when pharmaceutical organizations bravely challenge the status quo and embrace CRMs with technological advancements to meet evolving customer expectations.